The first month of the year and that means it's time to take a look at the results.

In this blogpost I will list my dividend income for the month of January 2018.

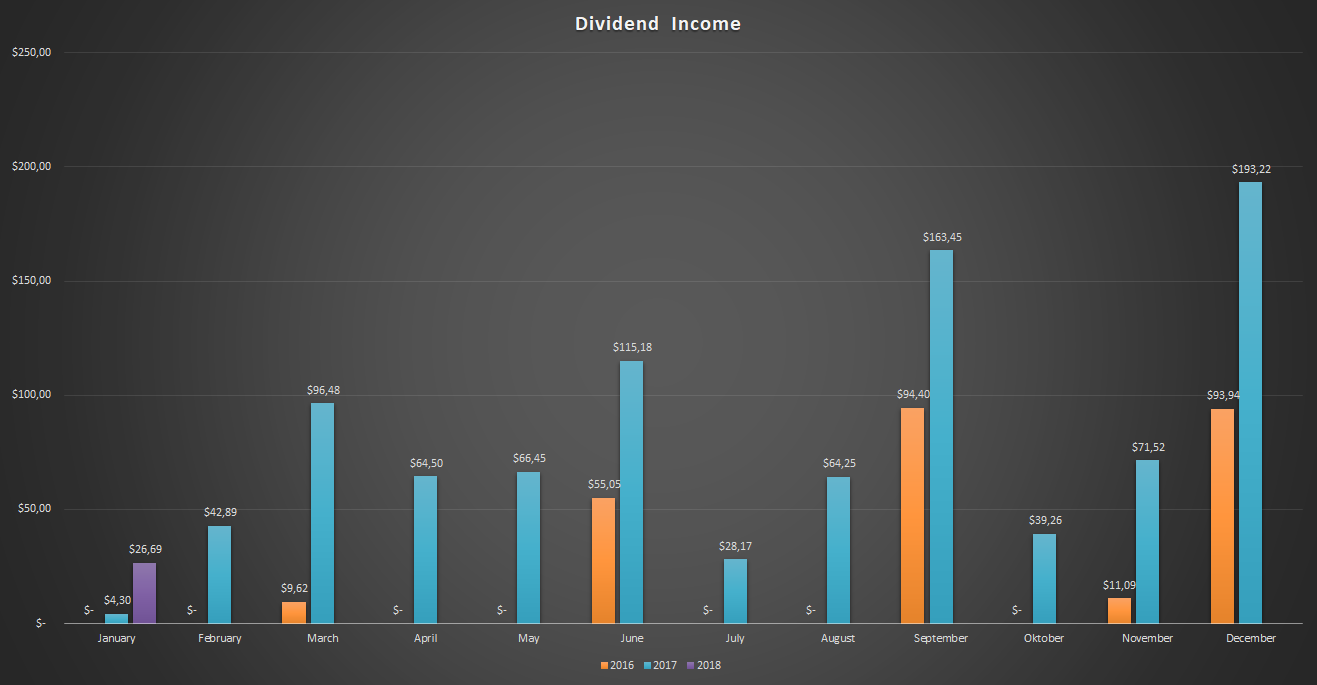

In January I received a total of $26.69 in dividend income.

The following stocks paid me a dividend:

Cisco (CSCO): $22.18

Realty Income (O): $4.51

Not a whole lot, but January typically is one of the smaller months, because most stocks pay their dividend during the second and third month of the quarter.

All dividends are after dividend taxes of 15%, but I can reclaim this via the dutch IRS, so there's an added bonus there when I do my taxes for 2018 (in March 2019).

Last year January I received $4.30. That means that this years January dividend income is a 520.69% increase from last year January. Talk about growth!

Here's the updated dividend income graph:

Portfolio changes

I haven't really taken the time to write about the purchases (and sale) I made last month, sorry! So let's take a look now.

I made one sell decision. After giving it a lot of thought I decided to sell my 60 shares of Omega Healthcare Investors (OHI) for a price of $27.15 per share, for a total of $1.629.24.

OHI is a real estate investment trust (REIT) that focusses primarily on skilled nursing facilities. It's a relatively small company with a market cap of $5.461 billion. Honestly, I don't really know why I decided to buy this company in the first place, a little over a year ago. Probably the high yield.

Well, it's because of that yield that I have decided to sell it now, as it reaches a yield of 10%. That's just not healthy! With rising interest rates, quite a lot of debt on the balance sheet, and the class action lawsuit against the company, I just no longer want to be invested in this company.

Recent buys

I also made 2 buys during January.

I bought 20 shares of the Walt Disney Company (DIS) for a price of $111.55 per share, for a total of $2,231.14. For more information on this company you could check out this article by Jason Fieber where he talks about DIS.

I also bought 23 shares of Medtronic (MDT) for a price of $86.26 per share, for a total of $1.984,02. This article by Jason Fieber makes a strong argument for owning this stock.

What about you?

How was your month? Got some nice juicy dividends as well? Made some nice purchases? What do you think of my sell decision on OHI? Make sure to leave a comment.

Thanks for reading.

SD

Disclaimer: I am NOT a registered investment advisor, financial advisor or tax professional. Any information found on this website is not a substitute for professional advice. This website should be viewed for entertainment purposes only. No guarantees or promises are made regarding the accuracy, reliability or completeness of the information presented. Please consult with an appropriate professional before investing any of your money.